Taxes

Overview before specific topics

Apply a VAT rate on a product with Drupal Commerce 2:

https://www.drupal.org/project/commerce_product_tax

If you want to calculate the tax type per variation programmatically:

https://www.flocondetoile.fr/blog/apply-vat-rate-product-drupal-commerce-2

It includes an example of determining the VAT rate to apply depending on the type of product.

There are some additional modules to manage taxes:

European VAT

We need help filling out this section! Feel free to follow the edit this page link and contribute.

Swiss VAT

We need help filling out this section! Feel free to follow the edit this page link and contribute.

Canadian GST

We need help filling out this section! Feel free to follow the edit this page link and contribute.

US Sales tax

We need help filling out this section! Feel free to follow the edit this page link and contribute.

Custom tax rules

We need help filling out this section! Feel free to follow the edit this page link and contribute.

Commerce Product Tax

Overview

Commerce Product Tax provides a user interface for selecting applicable tax rates on the product variation.

This module provides a commerce_tax_rate field type, which allows selecting a standard, reduced or no tax rate, in cases of tax free products.

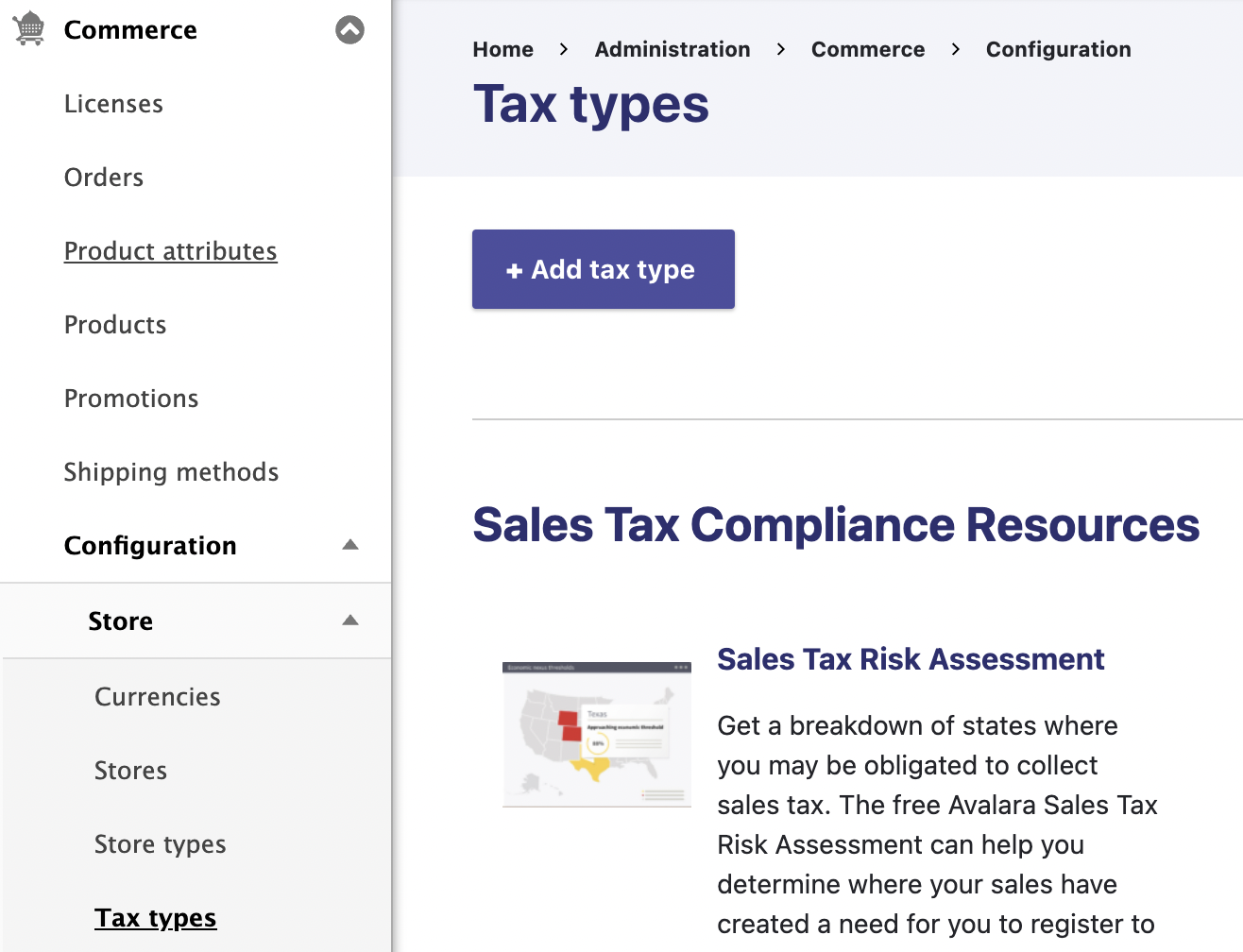

Adding a new Tax Type

You will need to add a new tax type to your Store.

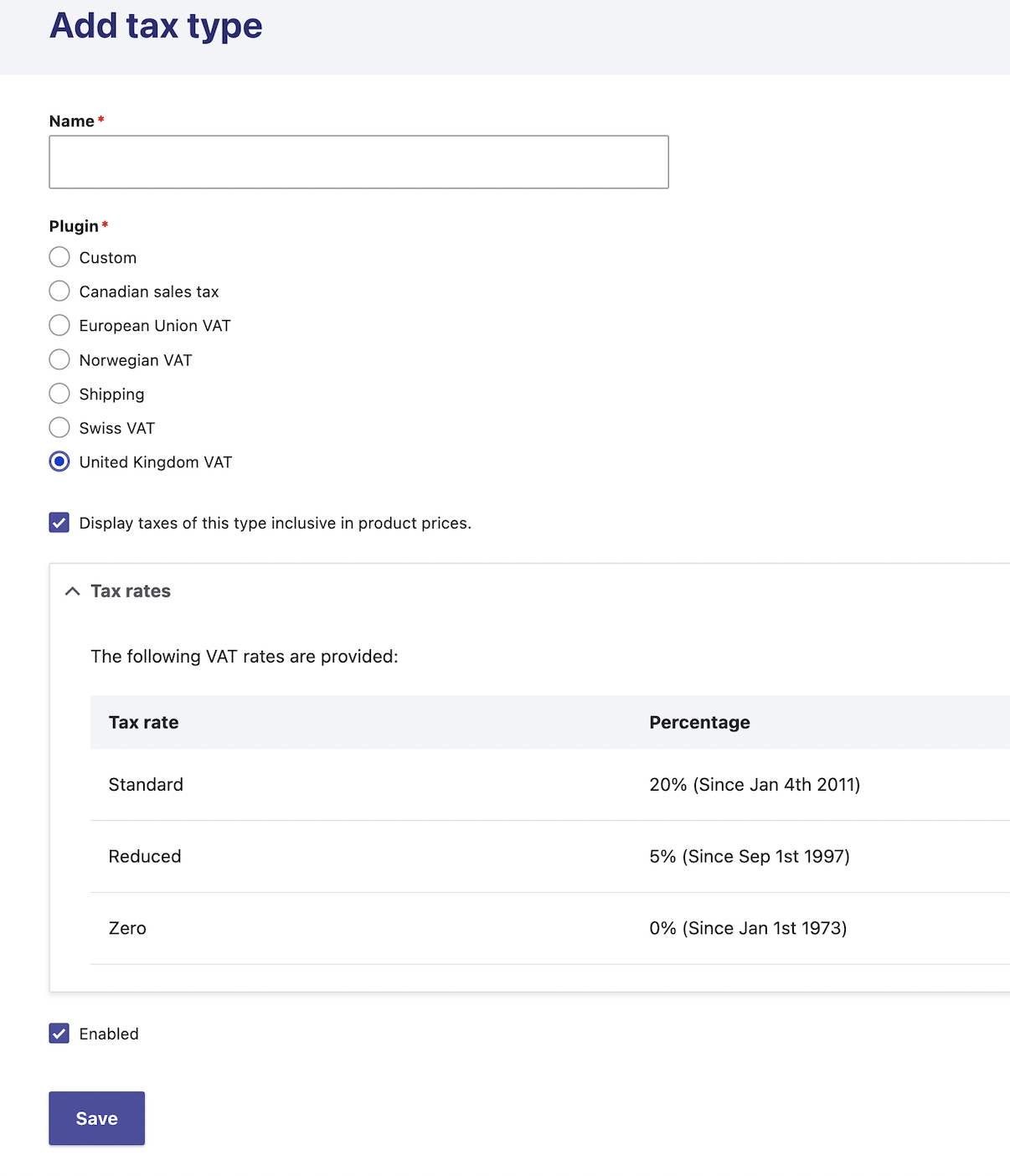

Select a tax type from the available plugin options and you will see a list of the tax rates. Give the tax type an appropiate name and click save.

Update Product Variation types

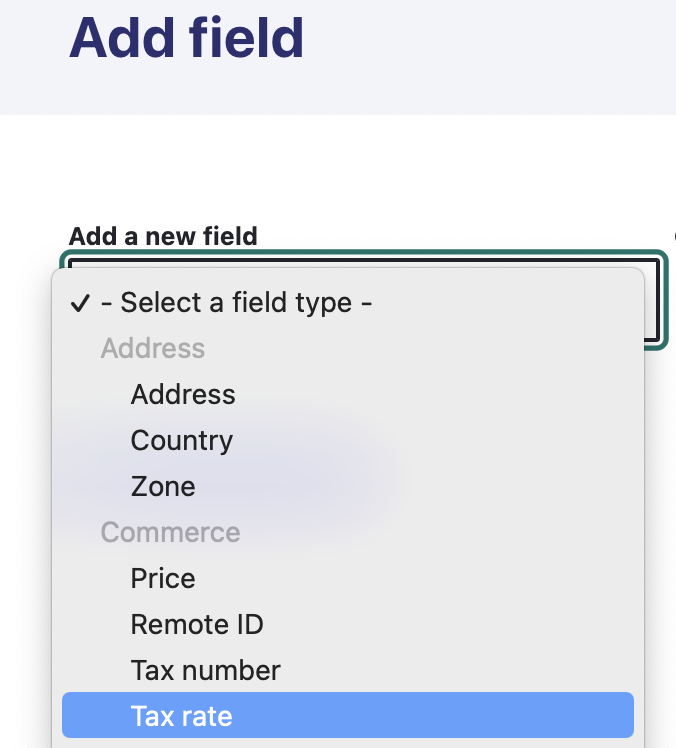

Next you will need to create a new field for your product variation(s).

Select Tax rate from the dropdown and give the field an appropiate label.

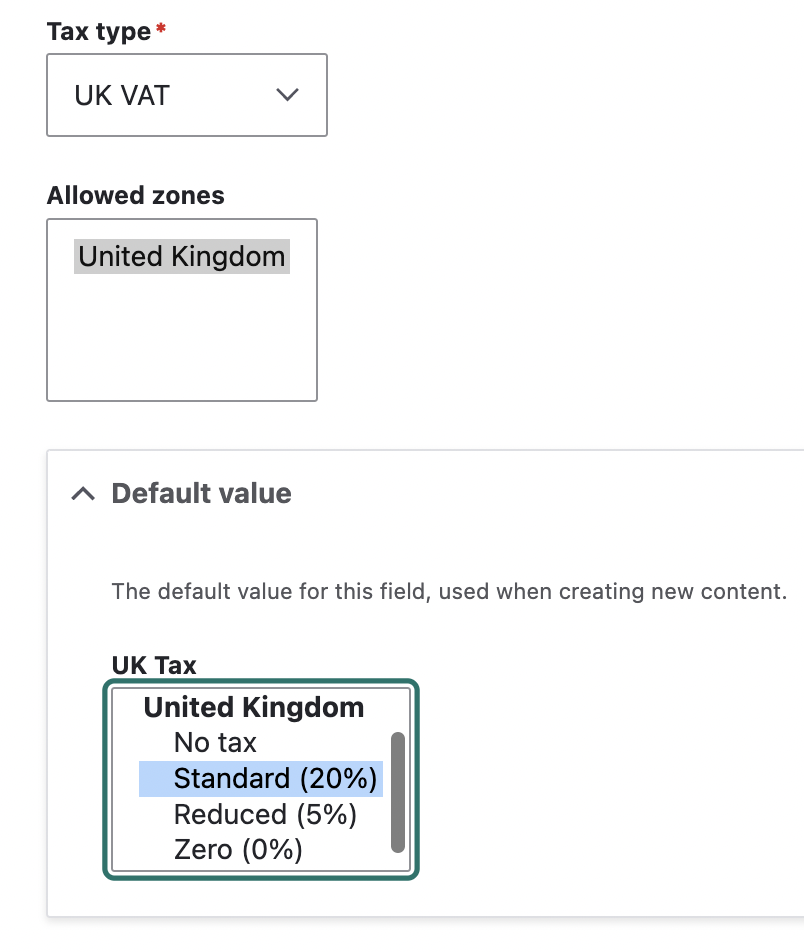

On the next page, you will be able to select what tax type you wish to use and the allowed zones. You can also set the default value to the Standard rate or a reduced/zero rate.

Update Product Variations

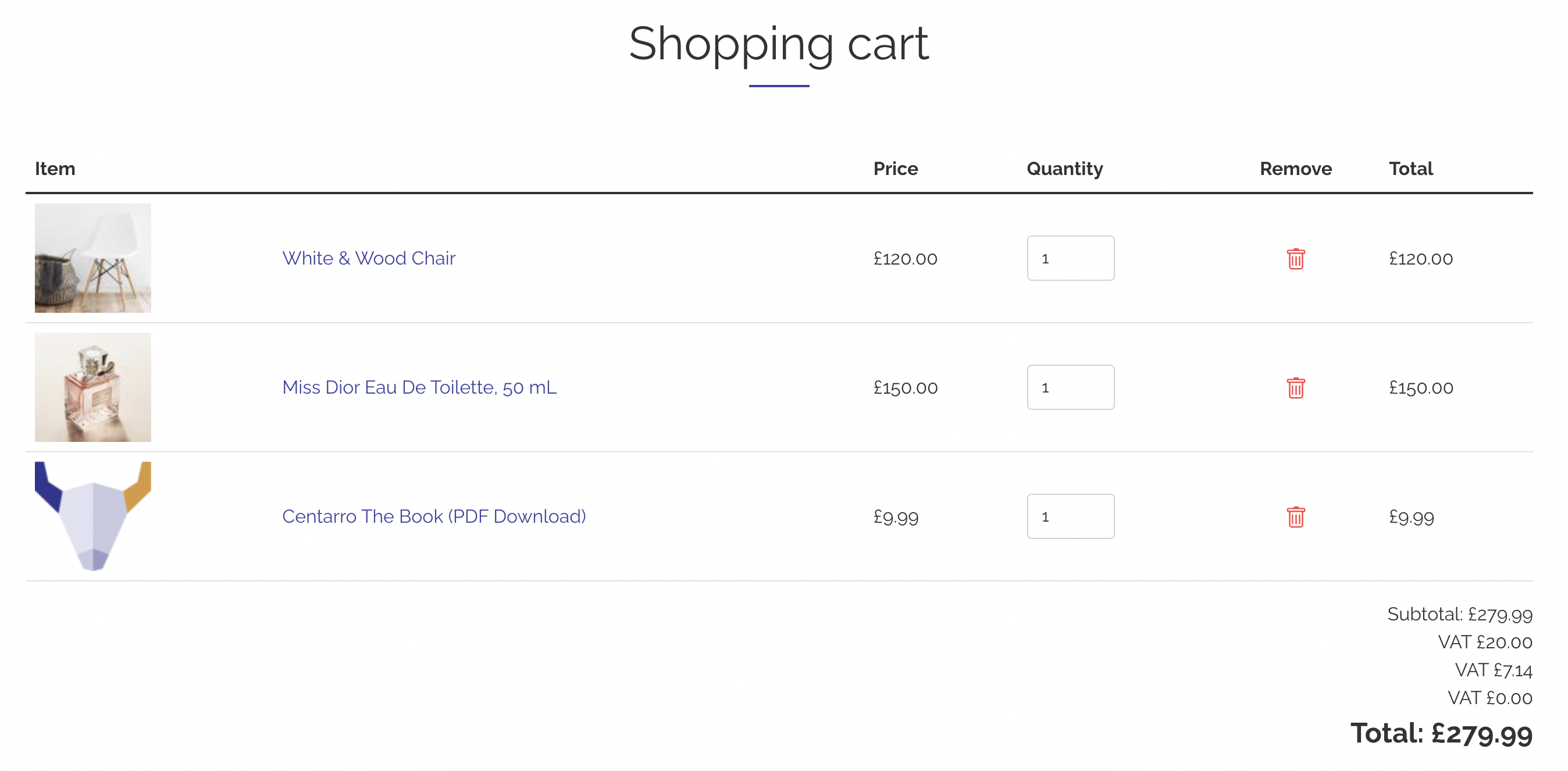

You can now edit your product variations and select the applicable tax rate. Depending on your Store settings, your tax rate will be visible on the cart page. If you have products with different tax rates, they will be displayed on separate rows.

Note

If you have multiple stores, you can add multiple tax rate fields to a product variation. For example, a product could have a UK tax rate of 20% and a ROI tax rate of 23%

Example

We have a UK based Store that sells both physical and digital products. Most products have the standard 20% VAT tax rate. Digital products are exempt and have a zero rate. Some products have a reduced rate of 5% VAT.

When viewing the cart, we can see the three different levels of tax applied. All prices displayed are inclusive of VAT.